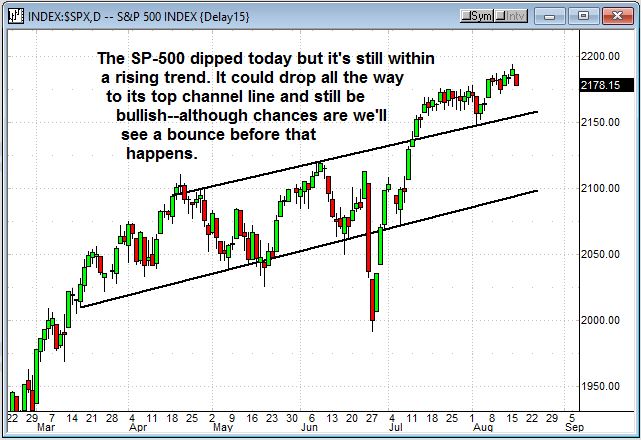

Today the SP-500 gapped lower at the open and faded for the rest of the day prompting some market watchers to ask whether the upside momentum we've seen for the past month is starting to fade.

We'd have to see a lot more downside to make that call as the index is still churning inside a predictably rising channel–a channel we've been selling outside of for some good results. We sold a put spread on the SPX last week and then a call spread Friday to form a condor with both expiring for a 3-day 14% return.

And the amazing thing is it was on a trade that originally went against us proving once again this stategy is the best at providing second chances.

That worked out well but to find out where this week's profits may be hiding let's first take a look at…

The Markets and How They Affect Us

The SPX pulled back today but we'd have to see a lot more selling to break this trend…

The market pulled back today on renewed rate hike fears. New York Fed President William Dudley warned "the September meeting is not off the table". While Atlanta Fed President Dennis Lockhart went on record that he expects one more rate hike in 2016.

We'll get the FOMC minutes from the last meeting tomorrow afternoon–and that could calm investors–but then we've got Yellen's spreech on the 26th. Janet Yellen will give a speech at the Jackson Hole conference and analysts believe she will try to prepare the market for a September rate hike.

The problem is the economy just isn't strong enough to sustain a rate hike and the Fed knows it. They try and talk rates higher, but it's extremely unlikely they'll hike this year–particularly right before the Presidential election.

And that's doubly true in light of the CPI numbers today. The Consumer Price Index (CPI) was flat at zero for July matching analyst consensus estimates. This was after a +0.2% rise in each of the prior two months and a +0.4% rise in April. Today's weak CPI goes a long way toward reducing the chances of a September rate hike inspite of those Fed President comments.

And this market needs low rates to keep on climbing. Earnings expectations are still expected to be negative for the current quarter as earnings for the S&P 500 index are currently predicted to be down -2.6% from the same period last year, which is a decline from expectations of flat earnings at the start of the quarter.

There are some bright spots though. The Atlanta Fed forecast is for 3.6% GDP growth in Q3—well over analyst consensus projections for 2.6% with some high profile analysts expecting from 1.8% to 2.2%. Surprisingly the Atlanta Fed has been right on the target in the past so perhaps we've got more growth ahead than what appears.

And to add to that growth construction is booming—multifamily building permits were up sharply from 415,000 to 441,000. Plus housing starts would have been higher but the West saw a -5.9% decline due to the impact of forest fires and drought. Starts in the Northeast spiked 15.5%, South +3.5% and Midwest +2.3%–those are some pretty strong numbers and indicate construction is continuing to expand.

The markets pulled back today and may continue tomorrow, but any retracement is liable to be light. Traders are still looking for reasons to buy–the question is–

How Do We Make Money on It?

Our first trade is on a stock that released earnings good enough to drive it straight up for several weeks–but today it retraced a bit giving us an excellent opportunity to sell a new put spread below support for a generous 10-day 19% gain.

And for our Roth Retirement trade we're looking at an out of the money condor for an extremely generous return if both sides are filled.

We've got two good looking trades lined up to take advantage of the current market–so let's get to it…

Click here to gain access to today's picks.

Keep up the good work,

Peter