After the biggest breakout in the past five years the SP-500 has finally started to sputter as it digests the gains of the past two weeks.

We had to close a lot of positions in the wake of that run-up–but now the scene is looking better for some prudent premium harvesting.

So to find out where the best trades are now let's first take a good look at…

The Markets and How They Affect Us

The SP-500 has run remarkably higher over the past 2 weeks, but now it's slowing down…

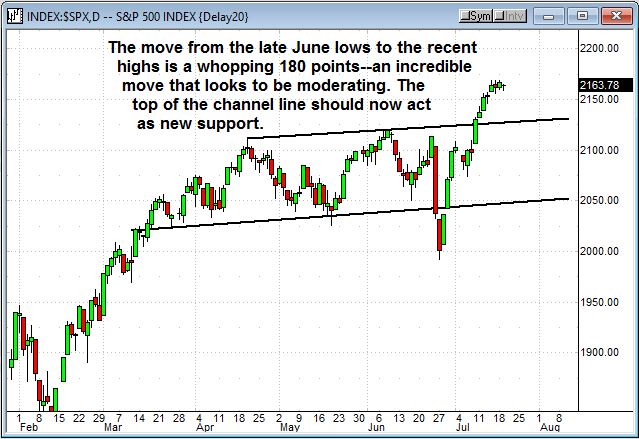

As you can see from the chart above the market has run for an amazing 9% run from the post-Brexit lows, but now it looks ready to digest that move with some sideways action–which finally opens the door to sell new spreads.

The SPX hit 2,168 on the opening gap Thursday and has been trading in roughly a 10 point intraday range ever since. All the indices are seriously overbought from the post Brexit rebound and they need a decent dip to give cautious investors something to buy. Traders are hesitant to buy a top that has lasted for five days because it's an indication momentum is fading.

That fading momentum could cause some profit taking–even if it's just a temporary dip.

Bank of America Merrill Lynch said cash levels held by fund managers hit 5.8% in the latest fund survey marking the highest level since November 2001. Meanwhile equity hedging is at the highest level in the survey's history. That means fund managers don't quite believe the rally will last–or at least want to insure against a potential breakdown. Apparently they are cautious in the face of deteriorating fundamentals, but are still willing to buy the big names.

One of the reasons the big cap established stocks are thriving is yield. More than 90% of Japanese government bonds carry a negative yield today – meaning "investors" in these bonds have to pay interest, rather than receive it. About 84% of German government bonds (known as "bunds") – the benchmark debt of Europe – trade with negative yields as well.

In fact Merrill Lynch estimated there is currently 12 trillion dollars of negative yield bonds in the market today–and that means any positive yield looks good.

According to Christine Hughes of OtterWood Capital Management, an incredible 63% of stocks in the benchmark S&P 500 Index are now yielding more than 10-year U.S. Treasurys. As Hughes noted, in a world of negative interest rates, more than two-thirds of the U.S. stock market is looking pretty good right now. So in that context it's not hard to see what's driving this rally–in spite of expectations for another negative earnings quarter.

However there is one sector that isn't doing so well–and that's commodities. The Dollar Index soared to a four-month high on the drop in the European Investor Sentiment report released today, and better than expected housing starts. The spike in the dollar weighed on commodities including oil, which fell to $44.59 on its way to $43 or even lower.

The strong dollar is going to make Q3 earnings a challenge–and could push estimates back into negative territory from their current +0.6% expectations.

However for now earnings are coming in better than expected. Microsoft (MSFT), United Healthcare (UNH) Goldman Sachs (GS) and Lockheed Martin (LMT) all reported today and all beat estimates. And all are rising. Keep in mind the best and biggest companies report early in the season so this is where we'd expect to see upside surprises. Since this week is all about earnings, these reports are bullish for the markets.

However we're not seeing a lot of conviction recently. Volume has been weak at 5.6 billion shares on both days this week indicating a definite slowdown after the recent buying spree. It's going to take a lot of good news to drive the markets higher than the 9% they've already soared since the Brexit vote. That's a big move for such a short time–a move that sometimes takes an entire year.

Meanwhile August and September are seasonally the two weakest months of the year–and the end of July after earnings normally fades into that weakness. The influx of cash from Europe is supporting the market–but that money will likely divert to the bond market on any substantial stock pullback.

So we've got a market that looks like it's peaking, a lot of money still flowing into our markets looking for yield, and a dollar hitting new highs putting pressure on commodities–the question is…

How Do We Make Money on It?

Our first trade is a call spread on an index that broke down today after tracing a new lower high–something it's been doing for the past year. With that kind of history traders will be skittish enough to get out before it really sells off–and we'll be taking advantage of that for a potential 10-day 19% profit.

And for our Roth Retirement trade we're also looking at a far out-of-the-money condor sold both above any projected gains for our time period–and below support for what looks to be some healthy but safer gains.

We've got two good looking trades lined up to take advantage of a market treading water–so let's get started…

Click here to gain access to today's picks.

Keep up the good work,

Peter