This past week traders have been getting increasingly nervous that the Brits will vote to exit the European Union–an event that has been likened to a bomb hitting the markets.

All that worry however has created some pretty range-bound trading–and for us that usually turns out to be a good thing. So it was in this case as our latest SPX trade expired this past week for a fast and generous 28% gain.

But what about now? The Brexit vote is just two days away and the result could explode the markets one way or the other–so how do we trade it?

To help answer that question let's take a look at…

The Markets and How They Affect Us

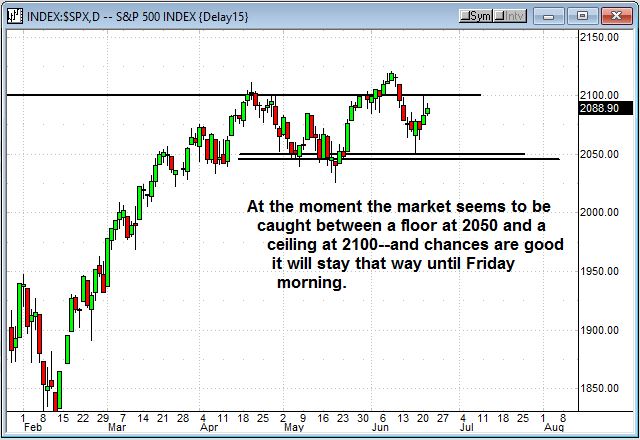

As you can see we've had a range bound market since the middle of April–but the Brexit vote has a good chance of breaking that channel…

As you can see from the chart above the SPX has been range bound for awhile, but most recently it's been kicked between 2050 on the bottom and 2100 on the top. And for the past couple of weeks the main driver has been the Brexit vote coming up this Thursday. In fact this one overriding influence is so great we'll be devoting most of this week's update to analyzing it. Heck even the survey's seem to have a powerful effect on our markets.

If a 'leave' poll gets published the market tanks–but if a new 'stay' poll hits the news the market rockets higher–like the gap up we saw yesterday morning. Imagine what will happen when the actual vote takes place!

Tomorrow we get four different surveys out of Britain and they all have the potential to move the markets. There were several surveys out today, but they were inconclusive with different results in each.

The Survation poll showed the stay camp had lost some momentum, but it was still slightly ahead at 44.9% compared to the leave camp at 43.8%. The prior Survation poll published on Sunday had it 45% stay and 42% leave. The leave camp was picking up that momentum the stay camp was losing.

The Financial Times Poll of Polls represents 25 different surveys, and as a compilation is probably the most accurate of all. The compilation is showing an average of 44% remain, 45% leave. The bottom line is the vote is way too close to call at this point.

If you are wondering why this is such a big event it's because it has much greater implications than just on Britain. For the world economy the UK leaving the EU is not the problem–it's the other countries that will also be agitating for an exit if the Brits vote to leave.

France and Italy have already expressed a desire to go back to an independent status. Italy is suffering from the EU rules and wants to go back to its own currency (Lira) and abandon the Euro. Wage and cost inequality between all the Eurozone countries makes it difficult for some countries to compete–and that's causing some dissention.

Because of the potential follow on effect after a UK exit, the EU ministers are likely to exact a stiff price from the UK in terms of restrictions on travel, trade and financial access. They have to make it so painful that other countries will think long and hard before starting their own exit plans. And that's why many think an exit vote will plunge the entire country of Britain into a recession.

The voting begins Thursday morning and because they are so far ahead of us in time zone we'll get the first counting area results about a half hour before the market closes on Thursday–so we'll expect to see a little advance action going into the close. But of course the real fireworks won't start until Friday morning–expect a big morning gap one way or the other.

Because there are no exit polls, hedge funds and investment banks have commissioned private exit surveys to give them a head start on trading. That means we should have a hint on direction just before the close on Thursday, but know for sure by watching the S&P futures Thursday night.

At this point the market direction is a daily coin toss unless the polls released tomorrow suddenly begin to widen with a clear outcome in sight. Even then, we can't be sure what the market will do once the event occurs–and whether or not the result will be what the polls predicted.

If I had to guess I'd say Britain will vote to remain in the EU because of the fear an exit will create a recession. I also think the establishment has too much to lose to allow an exit vote so unless there is a huge popular uprising chances are good the 'stay' camp will prevail in spite of what the polls are saying right now.

We can also see our markets banking on a 'stay' vote as the bias has been generally higher since last Thursday's bottom. However markets are often blind-sided in one direction or the other–but that doesn't mean we have to be. We trade a strategy based on predictable market ranges–and the open on Friday has the potential to blow out the restraints one way or the other.

So How Do We Make Money on It?

Because we have no way to truly tell which way the vote will go–or what the market's reaction will be–there is no compelling reason to instigate new trades tomorrow–and some powerful reasons not to. Keeping our powder dry may not only save us money, but could make us a bundle if we get a compelling opportunity Friday morning or early next week.

In fact it would be smart to remove the risk we already have by closing our existing trades so we can ride through this thing with zero market risk.

That's good money management until we know which direction this thing is going to go. On Friday morning we can size things up and see if some new spreads are in order. For example if we see a really big gap higher those are often reversed once traders realize the US economy isn't suddenly robust, and we've got another lackluster earnings season on the horizon.

But at this point it's just too early to say. So let's look for an opportunity over the next two days to close our existing positions. I would like to be able to do that for .50 or less each, but with implied volatility remaining inflated until the vote we may have to be content with a closing just below what we paid. As of today's close we are just a little above what we paid on both our RUT and SPX positions–so between time decay and any market dip lower let's look toward closing those positions at a profit–even if it's a small one. We can always get in again once direction becomes obvious.

So that's it for tonight. We rarely skip a week of trading, but in this case it makes a lot of sense. There will be plenty of premium to collect once the news hits the wires.

Click here to gain access to The Winning Secret

Keep up the good work,

Peter